Reflecting on 2023, Looking Ahead to 2024

Twelve months ago, I reflected on the difficulties in investing in CRE due to the uncertainty in the market and current status of the T-bill in my white paper “Maximizing... Read More

Complicated and multi-faceted endeavors with a large number of involved parties, construction projects encompass a broad range of potentially risky points that can result in grave financial consequences if the project is managed improperly. Lien waivers certainly fall into this risk category.

In themselves, lien waivers are a mere formality, a confirmation of an agreement being honored. If things go wrong in the construction process, though, disregarding lien waiver collection can make a bad situation even worse. Making sure that a tidy track record of lien waivers is maintained throughout a project is one of the most important aspects of a construction project.

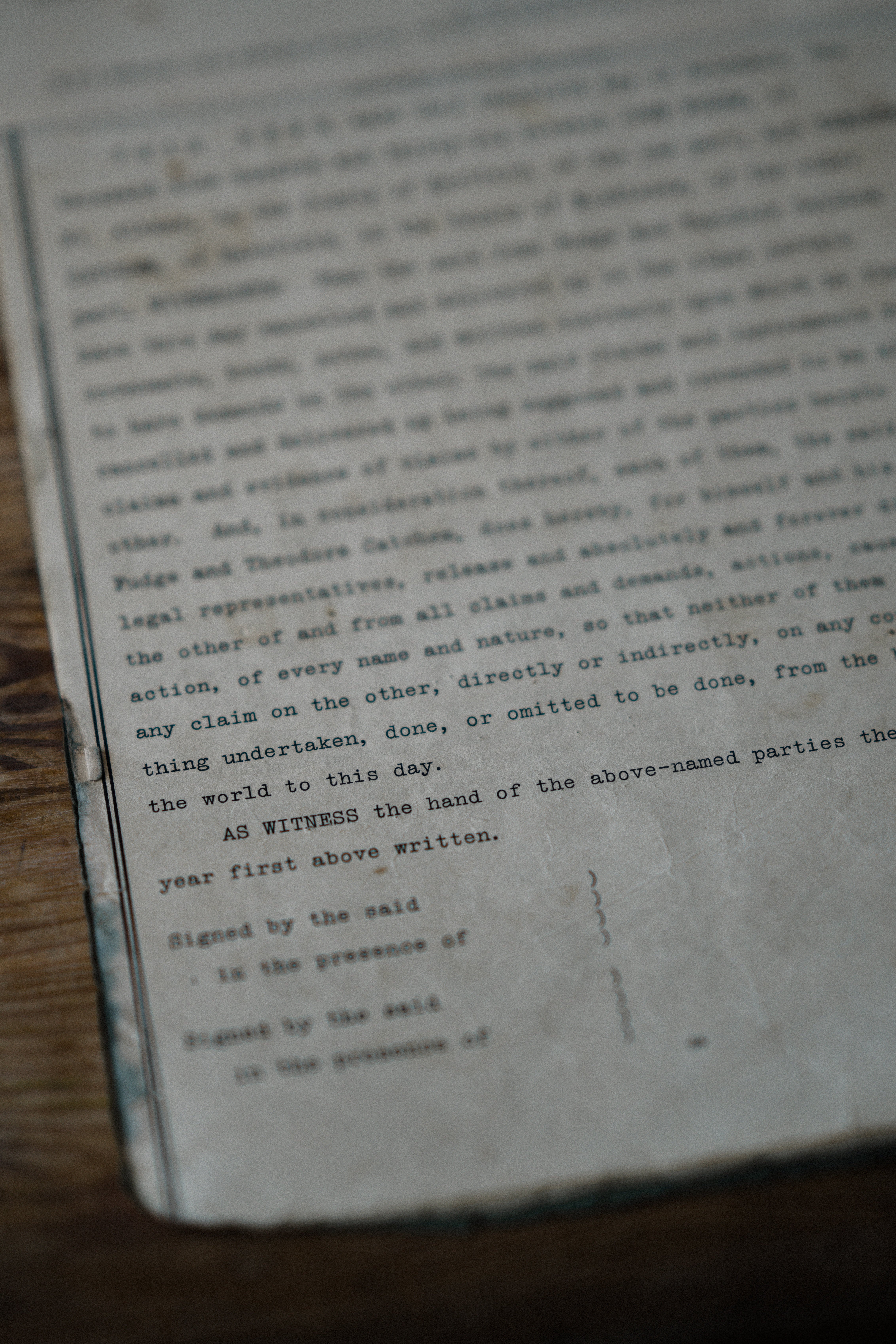

A lien waiver is a formal, legally binding document stating that the claimant (contractor, subcontractor, or supplier) has received payment for the agreed upon service or materials and therefore waives any rights to file a mechanic’s lien on the property. In short, a lien waiver serves as a receipt for payment, and any financial transaction in the project is generally accompanied by a lien waiver.

Depending on the scale of the project and the number of involved parties, keeping track of lien waivers can be a daunting task. This is particularly true for large-scale construction projects where the number of subcontractors and suppliers involved in various stages of the project results in an enormous number of lien waivers.

Lien waivers are generally divided into two categories: conditional and unconditional waivers. The main difference between the two is that unconditional lien waivers are effective as soon as they are signed, while conditional lien waivers are only in effect once a predetermined condition (most commonly, a payment) is fulfilled. Typically, conditional lien waivers are submitted with every contractor and vendor invoice, while unconditional lien waivers are signed by these parties upon receipt of payment.

Both types of waivers have two subcategories: waivers on progress payment and waivers on final payment. A waiver on progress payment is issued when the claimant is paid an agreed portion of their total pay (a monthly or other periodic installment), while a waiver on final payment is used once the claimant has been paid the total contract value.

Different states have different regulations and requirements regarding lien waivers and they sometimes dictate a specific type of waiver for construction projects, and, in general, conditional lien waivers are considered good practice, since they protect both parties. The claimants keep their rights to file a lien until they are paid while the payer is still protected from double payment.

Unconditional lien waivers are a bit riskier since they are effective immediately upon signing. For instance, a contractor can receive a check and sign a lien waiver, but if a check bounces the contractor has already signed a waiver and has no legal tools to recover the funds.

As we’ve mentioned, some states (12 of them, to be precise) regulate lien waivers more strictly and employ mandatory lien waiver forms. In such cases, it is a little bit easier to manage lien waivers, since state-issued forms carry no hidden risks and dubious wording. In states that don’t regulate lien waivers as strictly, there are no set forms for lien waivers. Various construction contracts contain similar technical wording (for instance, a “lien waiver” is not the same as a “lien cancelation”, nor a “no lien clause”.) So, it is essential to pay close attention to the contents and the conditions of the agreement.

In theory, lien waivers are beneficial to all involved parties, as they guarantee that all conditions of the agreement will be met. In practice, though, they can create major problems due to mismanagement or any attempts to manipulate the rules. As mentioned previously, management of these documents can be challenging due to the sheer number of involved parties.

Therefore, it is strongly recommended to employ the services of industry professionals capable of managing a construction loan in all its intricate aspects. Also, consider using a construction loan management application like Contract Simply that allows for easy collection, review, and storage of lien waivers throughout the life of a project.

Photo by Annie Spratt on Unsplash

Jump To