Reflecting on 2023, Looking Ahead to 2024

Twelve months ago, I reflected on the difficulties in investing in CRE due to the uncertainty in the market and current status of the T-bill in my white paper “Maximizing... Read More

Imagine that instead of biting your nails for five days (or is it nine days?) manually reviewing and approving a construction draw request, you can do it half the time. Given the fact that saving time and money is the name of the game, construction loan software aims to eliminate the need for various tasks associated with draw processing using machine learning and process automation. By allowing construction loan management technology to take on the mind-numbing workload, commercial lenders see reduced loan servicing costs, fewer incidents like short pays or overpayments, and an increase in lien-free completion of projects. Oh, and they’re able to process draw requests in half the time.

Modern construction loan management tools are cutting workload, eliminating data entry mistakes, automating payments, and automatically tying lien releases to every payment in order to avoid the dreaded mechanic’s lien. With all of this in mind, let’s take a closer look at how construction loan software has become a shining star in CRE, residential and industrial lending.

Nobody likes doing paperwork and managing draws takes a heck of a lot more time to complete than anyone would like to admit. The administrative workload for processing and approving a construction draw request is document heavy, cumbersome, tedious, and prone to human errors.

Related: What is a draw request?

Loan administration software has been shown to decrease the administrative workload between 50% and 65%, often cutting processing time in half, making the job easy and straightforward by storing all data into a centralized location, and of course, eliminating human errors.

To help you visualize how to cut administrative workload in half, I’ve outlined an example use case showing how construction loan management software and machine learning can work hand-in-hand.

Use Case

Bank: First Federal

Challenge: Employee time devoted to the manual review of draw documents prevents growth and profitability

First Federal is a commercial lender with a construction loan portfolio worth $500M. Each loan within their portfolio requires a monthly draw request from the borrowers and general contractors. Each draw request includes hundreds of documents including invoices, receipts, change orders, conditional lien releases, inspection reports and much more.

Using the machine learning features within construction loan management software, they apply document learning and rule-based predictive modeling to process 1000’s of documents, emails, and spreadsheets packaged into each monthly draw request. Data is parsed so materials, like a PDF invoice, can be matched with a budget spreadsheet to validate disbursement amounts. Errors are also detected, and construction loan administrators are notified with both alerts and recommended courses of action.

Can you start to see how process automation takes on the mundane and manual tasks leaving employees time to focus on generating new business or other customer-facing roles?

“Manual review of 12,000 annual commercial credit agreements normally requires approximately 360,000 hours per year. Results from an initial implementation of this machine learning technology showed that the same amount of agreements could be reviewed in seconds.” TechEmergence

In the business world, and life in general, time really does equal money. So by cutting processing time with construction loan software, you’re already saving money, but by increasing existing portfolio interest revenue by 3% to 5%, you’re earning incremental money in the process.

Related: Top 5 Uses of Construction Loan Management Software

Moreover, by using a construction loan management process automation, loan and document errors can be detected three times more frequently. All of this allows the lender to process construction draw requests and manage construction loan obligations more efficiently, while the entire cost of the platform is typically incorporated into a loan origination fee.

Email continues to serve as a useful communication tool, and Excel continues to serve as a powerful calculation and graphing tool. However, have you ever experienced a long email thread with a variety of stakeholders sharing dozens of documents with multiple changes in each version? How about ensuring that all of the materials within that long thread of emails correctly match items within a spreadsheet that needs to be shared and edited by several people? Or, have you attempted to keep track of approvals and authorizations by way of email and Excel? What about setting notifications and action items or releasing funds and allowing borrowers to pay contractors directly through Excel? It’s too much for these tools and goes far beyond their intended purpose and capabilities.

Email and Excel were not designed to manage and communicate the entire draw process and become a frustrating and inefficient combo for many construction loan administrators.

Modern lending software is customized to help manage just about anything, including construction loans. Today’s technology not only allows you to track and manage the entire project from a central location but by simply answering a few questions about the relevant parties in the project and defining the documents you want to track, you can be up and running in minutes. What’s more, you can say goodbye to printing, scanning, and signing documents as nearly everything can be done, stored, archived electronically.

We know that Excel is exceptional at calculating and graphing numbers. However, you can now run your data through a construction loan management platform, making complex reporting infinitely easier for a loan manager.

Examples of real-time reports available in these platforms include:

Remember that there is a treasure trove of data in those PDFs and Excel sheets, but what good is all that data if you can’t manage it on a daily basis, get real-time status updates, check all lien releases, calculate cash-flow projections, and conduct a myriad of other crucial tasks?

Related: Eight Construction Loan Monitoring Reports That Crush Risk

By allowing you to micromanage and track your project from inception to completion, construction lending software helps with data management, predictive modeling, and taking action.

To sum it up, processing a construction draw request is easier now than it ever was, and good thing, too, because who knows how much longer both lenders and borrowers could have kept on with the old-fashioned methods and tools without losing their collective minds.

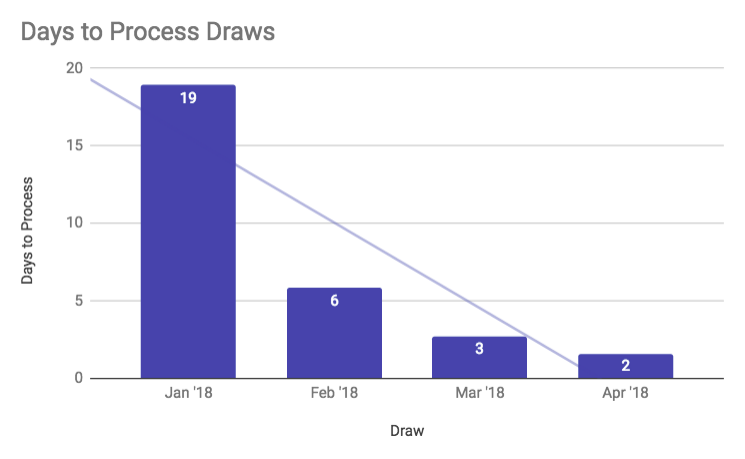

Lender example reduction in draw processing time using Rabbet

Lender example reduction in draw processing time using Rabbet

With a construction loan management software in place, you can have your draw request approved in half the time, and ensure a positive ROI across the board.

Jump To